2026 ANALYST PREDICTIONS

“An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today.” –Evan Esar

That quote resonated once again in financial markets this year. Analysts adjusted price targets sharply lower after Liberation Day in April, only to raise them again as markets rallied later in the year. Confidence shifted, narratives evolved, and forecasts followed prices rather than anticipating them.

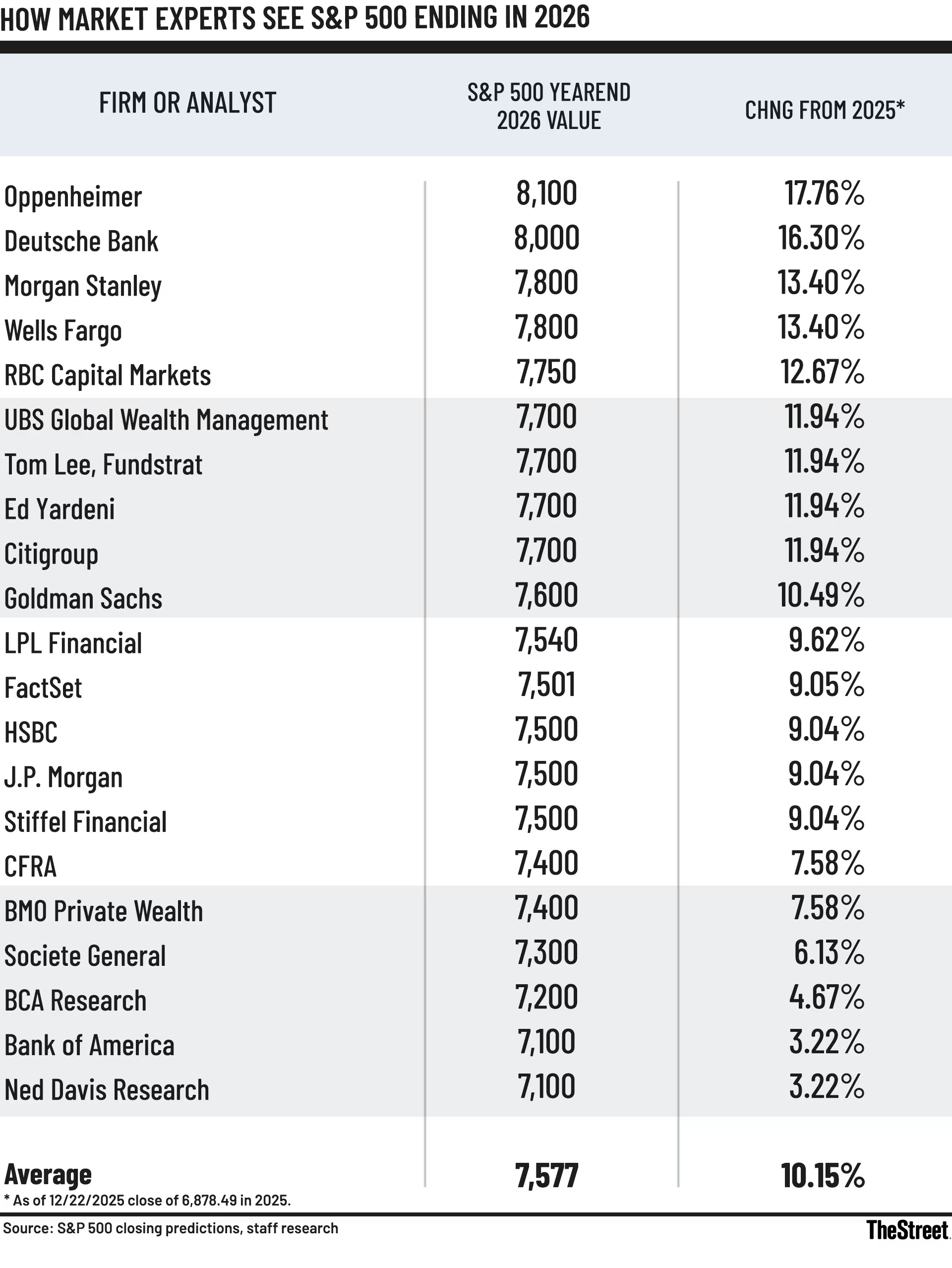

Now, as we close out 2025, Wall Street economists and analysts are once again publishing price targets for the S&P 500 heading into the new year. For Zizzi Investments, it has become a favorite year-end tradition to look not just at these forecasts, but at how far they ultimately deviate from actual market returns.

Looking ahead, when you average the major forecasts for 2026, they cluster around a familiar number, roughly 10 percent expected returns.

At first glance, that sounds reasonable. After all, the long-term average annual return of the S&P 500 is often cited at about 10 percent.

This pattern is not new. Heading into 2025, the average analyst estimate for the S&P 500’s year-end level was about 6,678, suggesting roughly a 10 percent expected return before dividends. This reflects the typical tendency for forecasts to anchor near long-term averages rather than reflect how markets actually behave year to year.

But here’s an important nuance. The market rarely delivers “average” returns in any given year.

HOW OFTEN DOES THE MARKET ACTUALLY RETURN AROUND 10 PERCENT?

Looking back at nearly a century of S&P 500 history, annual returns that fall in a narrow “normal” range, roughly 8 percent to 12 percent, are surprisingly uncommon.

This reality has been reinforced in recent years. Over the last three calendar years, the S&P 500 has consistently exceeded analyst expectations, with actual returns coming in well above where forecasts began each year. Once again, markets delivered outcomes that looked nothing like the tidy, average return projections suggested.

In fact:

- Only about 1 out of every 5 years lands in that 8 percent to 12 percent range

- Most years are far more extreme, either meaningfully higher or meaningfully lower

- Large positive and negative outliers are what mathematically create the long-term average

In other words, the average exists because of volatility, not because the market consistently behaves calmly.

WHY FORECASTS GRAVITATE TOWARD 10 PERCENT

Analyst forecasts often regress toward the mean. When uncertainty is high, anchoring expectations near the long-term average feels prudent, defensible, and intellectually safe.

But this tendency also masks the reality investors actually experience:

- Markets are lumpy, not linear

- Returns cluster in bursts, not steady progressions

- Short-term precision is far harder than long-term participation

A forecast centered on 10 percent may feel reasonable, but history tells us it is statistically unlikely to be right.

THE REAL RISK ISN’T WRONG FORECASTS, IT’S BEHAVIOR

The danger isn’t that analysts miss the mark. It’s that investors change behavior based on those expectations. When forecasts are optimistic, investors often take on excess risk. When forecasts are muted, they may delay investing or hold too much cash.

Both responses can quietly erode long-term outcomes.

A MORE DURABLE APPROACH

Rather than asking, “Will the market return 10 percent next year?”

A better question is, “Am I positioned to stay invested through whatever returns show up?”

Long-term success has far less to do with predicting the next 12 months and far more to do with:

- Diversification

- Discipline

- Time

- Staying aligned with your plan through inevitable surprises

As we head into 2026, uncertainty remains, as it always does. The market will almost certainly surprise us again.The goal isn’t to guess the return. It’s to remain positioned so that, whatever the return ends up being, it works for you, not against you in the long run.