The markets are throwing another tariff tantrum, and if you remember 2018, this probably feels like déjà vu. But while the market reaction looks similar, the economic backdrop is different. Back in 2018, inflation was low, but the Federal Reserve was aggressively raising interest rates, tightening financial conditions. Now, in 2025, inflation is higher, but the Fed is taking a more accommodative stance—holding rates steady and signaling future cuts. This shift in policy provides an important cushion for the economy, even as new trade uncertainties emerge.

Why Tariff Announcements Shock Markets

When tariffs are announced, the immediate market reaction isn’t just about the specific tax on imported goods. Instead, the concern comes from the uncertainty tariffs create, which widens the range of economic outcomes. Businesses and investors don’t know how global trade partners will respond, whether supply chains will shift, or if today’s policy will be reversed next month.

Markets prefer stability. When trade policy fluctuates unpredictably, companies delay hiring, expansion, and investment, leading to economic slowdowns. That’s why tariff announcements tend to cause volatility—not because of the tariffs themselves, but because of the confusion surrounding them.

A World That Was Never “Free Trade”

One thing to keep in mind: global trade has never truly been “free trade.” Every major economic power—the U.S., China, the European Union, and others—uses tariffs and non-tariff barriers (subsidies, quotas, regulations, and outright bans) to influence trade policy.

The U.S. has actually been on the lower end of global trade restrictions. Going into these 2025 tariff announcements, America had fewer trade barriers than many of our trading partners. So, it’s not tariffs themselves that are rattling investors. It’s the size, scope, and constantly changing messaging around them. Mixed signals create confusion, and when markets don’t have clarity, volatility follows.

How Tariffs Affect the Economy: From Sentiment to Hard Data

Historically, tariffs tend to first impact “soft data”—things like consumer sentiment, business optimism, and purchasing manager surveys. This is because tariffs increase uncertainty, potentially causing companies to delay hiring, expansion, and capital spending. Tariffs may also cause consumers to delay making purchasing decisions.

It takes longer for tariffs to show up in “hard data” like retail sales, corporate earnings, and GDP growth. In 2025, we’re now starting to see some signs of a slowdown in this hard data as well. Businesses are pulling back on investment, and some areas of consumer spending are softening a bit, although not falling off a cliff by any means at this point.

Are We Headed for a Recession?

Despite the market volatility and early signs of slowing growth, the majority of economists are not predicting a full-blown recession—just a moderation of growth. That doesn’t mean there won’t be challenges ahead, but it does suggest that the economy can withstand this uncertainty better than it did in previous cycles. We have to remember that economists are much better at putting context around events that have already happened, than actually predicting what’s going to happen. In 2022, there was nearly unanimous consensus among economists that we would have a recession, but it never actually happened.

Reasons for Optimism

While uncertainty is high, there were some strong buffers supporting the economy and markets, that should dampen the impact of tariffs.

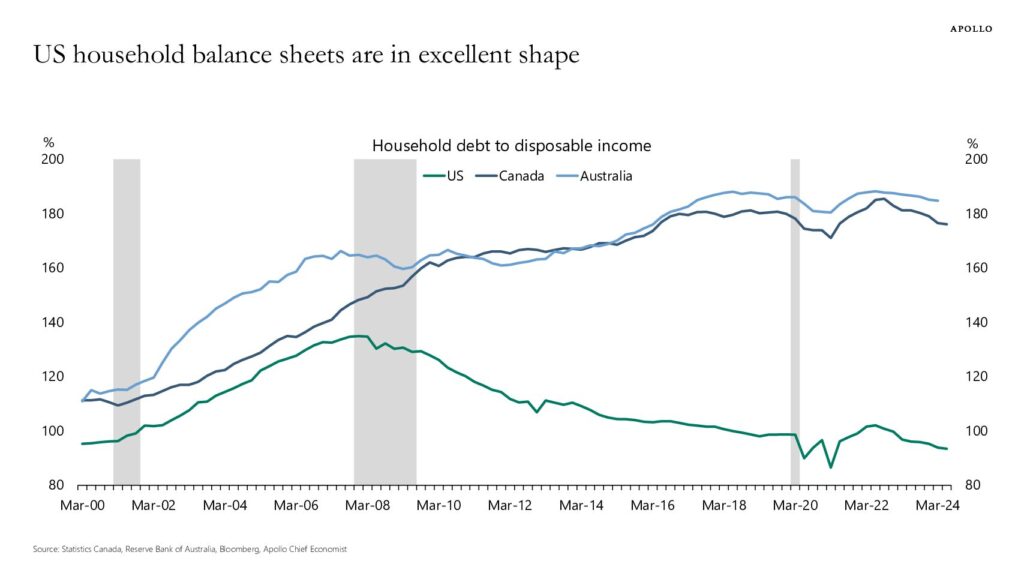

- U.S. households and corporations were in good financial shape heading into 2025, with low debt levels and strong balance sheets.

- There’s nearly $7 trillion still sitting in Money Market funds, providing liquidity that could flow back into the market if confidence improves.

- The Fed is no longer tightening, but instead becoming more accommodative with their policies, which historically helps stabilize markets.

At Zizzi Investments, we always focus on the long-term rather than short-term headlines. While different economic policies and administrations have come and gone, often creating short-term noise, staying disciplined and avoiding reactionary decision-making has been key to investing success. We’re continuing to monitor how these policies evolve, but our core philosophy remains the same: stick to a well-thought-out plan and don’t let market tantrums dictate your financial future. Diversification among different asset classes is finally working really well for the first time in years.

If you have any questions or want to discuss how this impacts your portfolio, don’t hesitate to reach out.